Partnering with a QR code ordering company can help national and community banks increase revenue in several ways. First, banks can offer QR code ordering as a value-added service to their existing merchant customers, providing a new revenue stream of software-as-a-service (SaaS) residuals. This can provide banks with turn-key revenue that can be anticipated to increase over time.

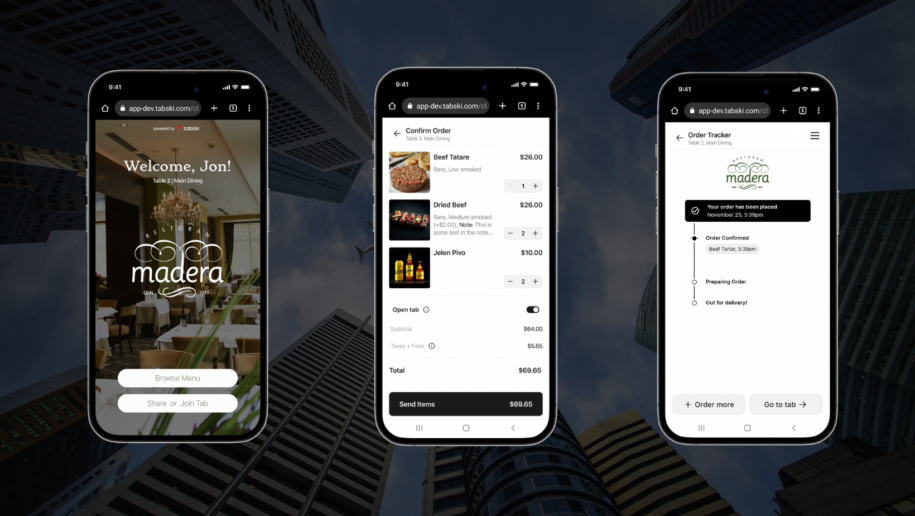

QR code ordering can also help banks attract new customers, particularly in the food and hospitality sector; restaurants, bars, wineries, breweries, hotels, stadiums, bowling alleys, airports, etc. As more and more merchants turn to contactless payment methods to combat labor shortages, QR code ordering has become increasingly popular. By offering this service to merchants, banks can position themselves as a go-to provider for contactless payment solutions and attract new customers.

In addition to increasing revenue and attracting new customers, partnering with a QR code ordering company can also help national banks protect commercial deposit accounts. By providing merchants with a convenient and secure way to accept payments, merchants can expect to see an increase in customer spending per visit between 20-30%. In turn, this increases merchant processing revenues flowing through their commercial deposit accounts.

QR code ordering can also help national banks better compete against fintechs by offering a unique and innovative service that differentiates them from traditional banks. With the rise of fintechs, traditional banks have had to work hard to keep up with the competition and offer services that are on par with those offered by fintechs. Partnering with a QR code ordering company can help banks stay ahead of the game and offer a service that fintechs may not be able to match.

Data on the increased adoption of QR code ordering shows that this is a trend that is here to stay. According to a report by Juniper Research, the use of QR code payments is expected to exceed $1 trillion by 2025, with much of this growth coming from emerging markets. This demonstrates the increasing demand for convenient and secure contactless payment solutions, and highlights the potential for national banks to capitalize on this trend by partnering with a QR code ordering company.

In summary, partnering with a QR code ordering company can help national banks increase revenue, protect commercial deposit accounts, attract new customers, monetize existing customer relationships, and better compete against fintechs. By offering this innovative service to merchants, banks can stay ahead of the competition and tap into the growing demand for contactless payment solutions in 2023.